Empowering your business with Open Banking data

Comply and compete with Open Banking

Open Banking provides an exciting opportunity to streamline and personalise your products and services.

Frollo’s Open Banking platform provides you with a complete toolset to use CDR data and gain a competitive advantage.

-

Learn more

Our CDR Gateway sets the standard in consent management and CDR data collection, with complete configurability, high reliability and advanced reporting features.

-

Our Data Enrichment engine turns raw CDR data into insights with market-leading accuracy. Transaction categorisation, merchant identification, bill tracking, income verification and much more.

-

Learn more

Streamline your lending decisions with our Financial Passport; a complete, real-time financial profile of your customers.

-

Learn more

Enrich your customer experience with powerful money management features and financial insights, driving engagement and value-add opportunities.

For many financial institutions, Open Banking starts with a need to comply. As a Data Holder you need to publish Product Reference Data and enable your customers to share their own financial data.

As Australia’s most experienced Data Recipient, Frollo can make Data Holder compliance a lot easier and more efficient.

-

Learn more

Our Data Holder testing platform provides the tools to confidently test all parts of the CDR specifications, across UAT and production. Automation and expert support ensure efficient and comprehensive testing, whenever you need.

-

Learn more

Our PRD Portal turns your obligation to publish Product Reference Data into an opportunity to gain a competitive advantage. Save time managing product data and keep an analyse competitor products in our competitive insights tool.

About Open Banking in Australia

-

What is Open Banking?

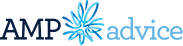

Banking was the first sector to launch as part of the Consumer Data Right (CDR) on 1 July 2020. Just as in the UK and other countries, in Australia, this is commonly referred to as Open Banking.

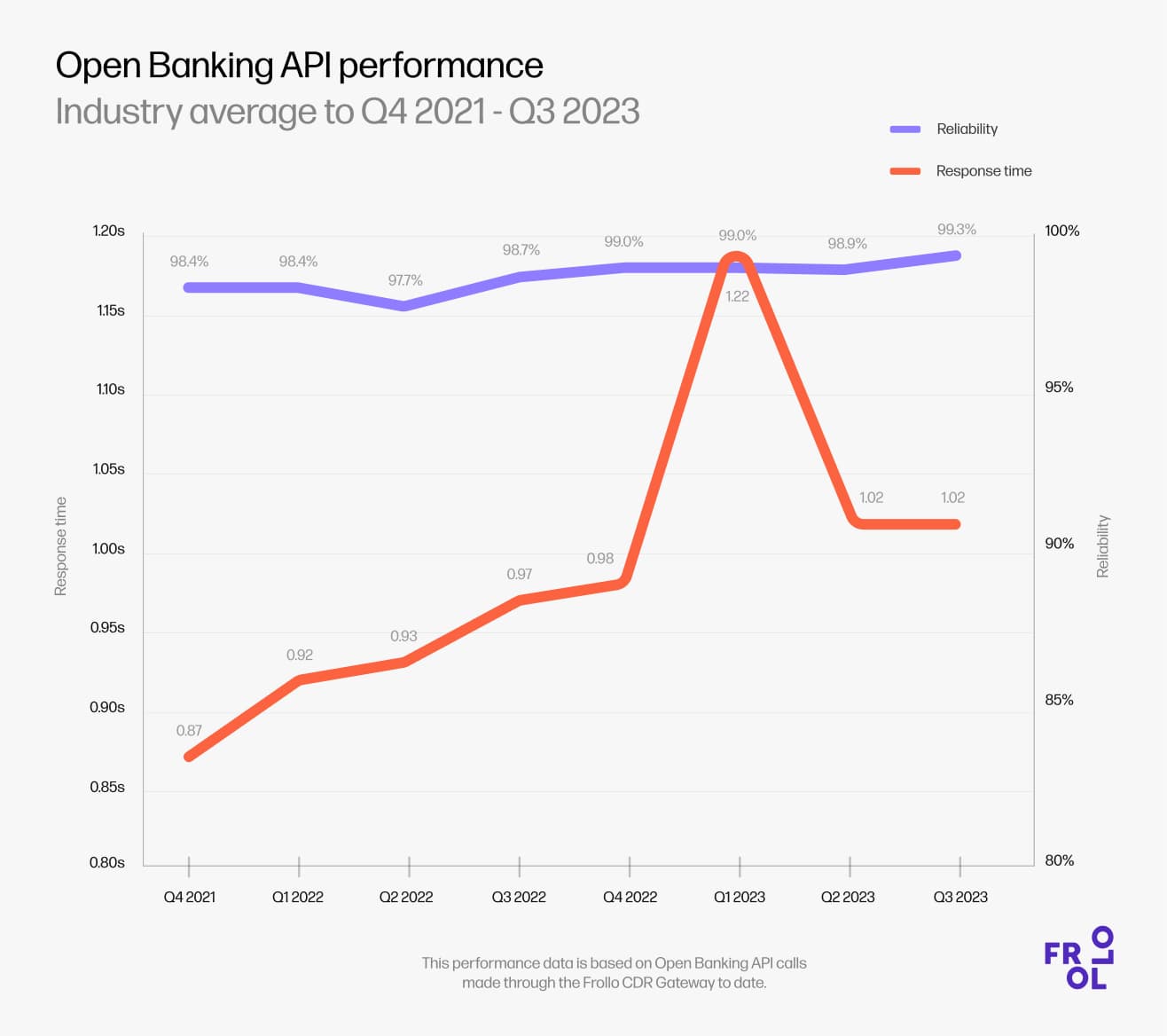

The Consumer Data Right (CDR) puts consumers in control of their data, by giving them the right to share their data between service providers of their choosing. More than 100 banks currently make it possible for their customers to share financial data with third-party providers.

-

A phased roll-out

In the first few years after Open Banking launched, a lot of work was done to make all of the banks (Data Holders) and their products available for consumers; as part of a phased roll-out, the Big Four banks were the first to enable data-sharing for their customers in 2020.

At launch, Regional Australia Bank and Frollo were the two companies that were accredited to receive Open Banking data. Regional Australia Bank allowed customers to use it for streamlining lending applications, and Frollo used Open Banking in its money management app.

-

Control over your data

Open Banking will ultimately give consumers more control over their banking data and how it is used. It enables them to safely share banking data with trusted third parties such as banks, fintechs and mortgage brokers, helping to significantly streamline many processes where financial data is required.

In short, Open Banking offers greater transparency for consumers, making it easier for them to manage their finances and get better deals – while also driving more opportunities for innovation and competition across the finance sector.

Read more by downloading the State of Open Banking 2024